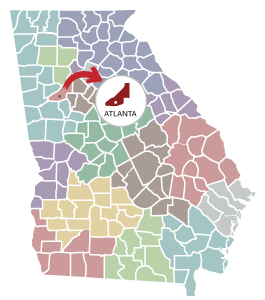

Atlanta Chapter

Atlanta Chapter Counties

- Fulton

2024-2025 Chapter Officers

President

Nikki Winston

404-265-0642

Vice President

Miranda Coleman

404-898-2000

Secretary

TBD

Treasurer

Michael Smith

678-742-2249

Meetings

The Atlanta Chapter holds lunch meetings on the third Tuesday of the month at 12 p.m.

Click on a meeting below to register:

New Members

Are you a new student, fellow or associate member of the Atlanta Chapter? If so, please call our chapter contact so we can welcome you!

Atlanta Chapter Contact:

Nikki Winston

404-265-0642