Tax Alert – Clarification on Filing for PTE Elections regarding HB 149 (SALT CAP Bill)

Tax practitioners have been reaching out to GSCPA and the Georgia Department of Revenue (GA DOR) asking for clarification on the statute changes and regulations regarding pass through entity taxable income. This tax alert is a direct result of GSCPA meeting with GA DOR staff and provides clarification around the following:

• Whether Georgia taxes are deductible when calculating PTE taxable income• How to handle PTE taxable income when including separately stated items of income or loss

Tax practitioners should be aware that certain tax preparation software products may not correctly treat all components of an electing PTE's income and deductions at the state level. Per GA Regulations, Chapter 560-7-3, 6a-b, a pass through entity "shall not be allowed any deduction for taxes that are based on or measured by gross or net income or any other variant thereof." This statement has been confirmed with the GA DOR – taxes paid are not deductible. Additionally, based on conversations we have been a part of, multiple tax preparation software platforms are not currently adding back the GA state income tax payments as required by the regulations for an entity electing PTE status. This is something to be aware of as you file these types of returns.

It has also been brought to our attention that certain software providers are not including Sec 179 and charitable contributions as deductible items for entities electing PTE status. Per regulations 560-7-3, 6a-b, "the federal taxable income of the Subchapter "S" corporation (partnership) as computed pursuant to the Internal Revenue Code of 1986 including the separately stated items of income or loss (such as charitable contributions, the Section 179 deduction, etc.); provided however, charitable contributions, the Section 179 deduction, and any other deduction which is subject to an Internal Revenue Code of 1986 limitation, shall be limited to what is allowed pursuant to the Internal Revenue Code of 1986 for a C-Corporation."

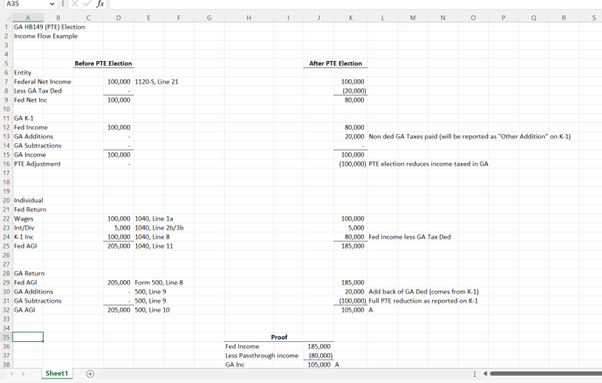

We have included a simple example of the GA add backs at the entity level and individual level that may be required depending on your tax preparation software. We recommend that all of our members pay close attention to the treatment of income and deductions at both the PTE and individual levels. At this time, manual adjustments may be required in order to file an accurate tax return. The Department of Revenue is aware of this issue, and we hope to have some resolution with the software vendors soon.

Download the PTE example sheet here >

Closing

GSCPA will continue to monitor this issue and promises to report back with any added updates. GSCPA continues to work for you and actively participates in the legislative process. If there are any questions on the above information, contact Don Cook, vice president, legislative affairs, at 404-504-2935 or dcook@gscpa.org.