Tax Alert - PTET Filing Issues- Do Not Amend Returns

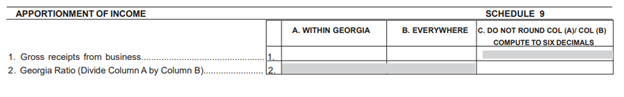

According to direct conversations with high level staff at the Georgia Department of Revenue (GA DOR), they are making corrections on their end for returns filed, so no amended returns will be needed at this point. For any returns filed going forward, as mentioned in previous alerts, you should complete the apportionment schedule on the Form 600-S (S-Corps). GA DOR is going to let tax software vendors know as well (they will continue to correct any that come in). If for some reason clients do not have receipts, you can put 1.00 in Georgia and 1.00 Everywhere in Schedule 9, and the 1.00 ratio will roll to the rest of the return. GA DOR is going to add a return rule to auto-populate any zero fields with a 1.00 ratio, but that will take some time to implement. The apportionment requirement had been a return rule for S-Corps prior to PTE rolling in. You can download the form here.

Since most of these will have payments associated with it, GA DOR has identified those first (which should be most). We could have some smaller returns with a payment that may have been refunded, but most would require manual approval, so the GA DOR has stopped these going forward until the returns are corrected. Upon correction, a proposed assessment will be issued for those where a payment was refunded. For those that did not have a payment, they’ll also be issued a proposed assessment as they otherwise would have been issued one anyhow.

If there was a payment and it was refunded, a notice of proposed assessment will be issued (first a web notice would go). So, you and/or client would get a notice of the change and it would be for the payment amount plus anything else due (e.g., penalties for failure to make estimated payments timely). Many payments have not been refunded (as GA DOR has tried stopping those) so there would be nothing to do for those because once GA DOR correct the returns, nothing would go out or occur (unless there’s a payment, partial payment, or penalty due). So practitioners don’t need to do anything. Those where a balance is due would go out anyhow as part of the standard billing process.

Closing

GSCPA will continue to monitor this issue and promises to report back with any added updates. GSCPA continues to work for you and actively participate in the legislative process. If there are any questions on the above information, contact Don Cook, vice president, legislative affairs at 404-504-2935 (Office) or 404-877-2154 (Mobile) or dcook@gscpa.org.